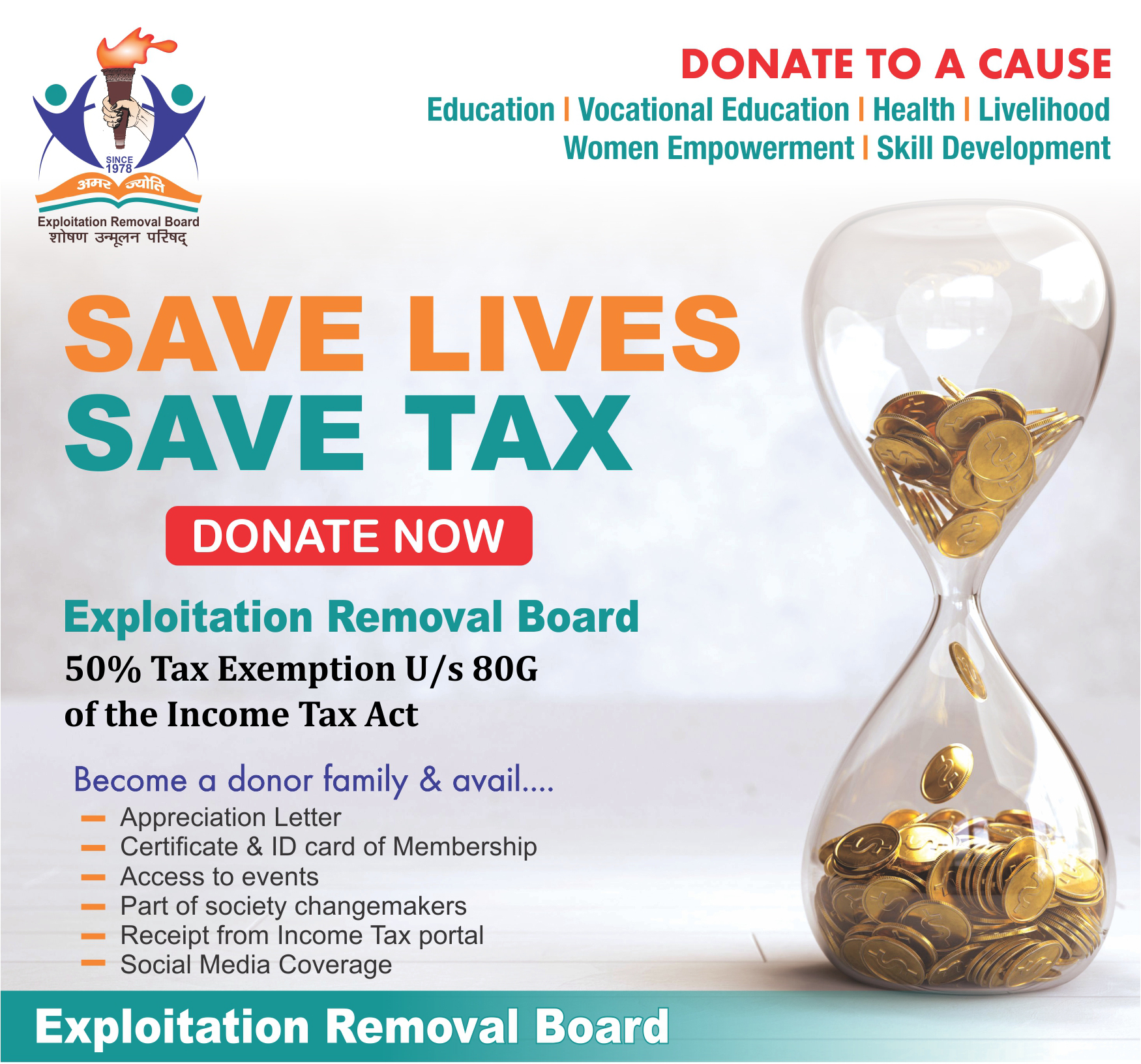

“YOUR CONTRIBUTIONS ARE ELIGIBLE FOR UPTO 50% TAX BENEFIT UNDER SECTION 80G AS EXPLOITATION REMOVAL BOARD IS REGISTERED AS NON PROFIT ORGANIZATION”

PAN: AAATE1297K | 80G NUMBER: AAATE1297KF20211

Even a small donation is a big help for someone in need and can provide long lasting support to underserved communities. Exploitation Removal Board work to provide better lives to underprivileged men, women, children and their families and our work is completely dependent on contributions made by socially committed.

When you make a donation under Section 80G to Exploitation Removal Board, you can claim a tax deduction on the donated amount. This reduces your overall taxable income, and you end up paying less in income tax. We are registered under Section 12A of the Income Tax Act, 1961 and the Societies of Registration Act, XXI of 1860.

Here are some common questions that you might have. If you don’t find what you’re looking for,

please write to us at info@nanakinstitute.com and we’ll be happy to address your query!

Section 80G of the Income Tax Act, 1961, allows you to claim deductions on donations made to eligible charitable organizations like Exploitation Removal Board. This means you can reduce your taxable income by the amount you donate.

You can claim deductions of varying percentages on your donation amount with a minimum donation amount of INR 500. The limit depends on the charity and the donor's category (individual or business).

Double Impact: Your donation under Section 80G not only supports a noble cause but also provides you with a valuable income tax exemption, making your tax planning better. You can enjoy the satisfaction of making a difference in the lives of those in need while reducing your income tax liability.

Yes, NRIs can also avail tax benefits by making donations to Exploitation Removal Board. Section 80G of the Income Tax Act allows NRIs to claim deductions on their Indian income for charitable contributions made to eligible organizations like Exploitation Removal Board. To ensure compliance with tax regulations and to make the most of these benefits, it's recommended that NRIs consult with their financial advisors and keep records of their donations and receipts for tax purposes. This way, they can support noble causes while optimizing their income tax savings.

Exploitation Removal Board will e-mail your tax-exempt certification (10BE) of all the donations you have made in a year by 31st May of the next year. For example, if you make 5 donations of Rs. 500 each in the financial year of 2023-24, we will send you the tax-exempt certification of all your donations by 31st May 2024. If you have changed your e-mail ID, contact us here for us to take note of the same.